Consumer Confidence is Crashing

Inflation, tariffs, trade wars and chaos in the White House are shaking up Americans belief in where the economy is heading

If you think the chaotic first few weeks of the Trump administration have been hard on the country’s political system—and your sleep patterns—imagine what they’re doing to the nation’s confidence in the economy and its future.

Trump was elected largely because voters felt Biden didn’t have a firm grasp on the economy. Under Biden, the nation experienced the worst inflation in 40 years, interest rates hit a decade high, and anxiety about job prospects grew steadily. Then came the soaring price of eggs, housing unaffordability, and the Democrat’s arguments that the economy was doing better than voters understood because the stock market was breaking new highs. While I’ve long argued that economic data alone doesn’t fully explain voter behavior—especially in an era of intense negative partisanship—there’s no debate that working-class voters moved away from Democrats in 2024 largely due to economic concerns. In previous election cycles (2016, 2018, 2020, and 2022), the traditional link between voter sentiment on the economy and actual voting patterns had weakened. But in 2024, we saw a return to more conventional behavior, with voters prioritizing economic issues over values-based voting.

How else do you explain the collapse of the predicted gender gap, the shift of 2022’s “Dobbs voters” toward Trump in 2024, and the historic rightward movement of Black and Latino voters as economic concerns reached record highs?

But now, all of those economic concerns belong to Donald Trump. Less than 100 days into his new presidency, it’s becoming increasingly clear that the aggressive economic policies and threats he’s using to reshape the world are causing significant unease among the American public. Predictably, partisans on both sides are retreating to their respective camps—but independents are abandoning Trump at historically high rates for any president this early in an administration.

It’s not just voters and public opinion. The concerns are manifesting in government projections.

According to CNBC “Early economic data for the first quarter of 2025 is pointing towards negative growth, according to a Federal Reserve Bank of Atlanta measure.

The central bank’s GDPNow tracker of incoming metrics is indicating that gross domestic product is on pace to shrink by 1.5% for the January-through-March period, according to an update posted Friday morning.

Fresh indicators showed that consumers spent less than expected during the inclement January weather and exports were weak, which led to the downgrade. Prior to Friday’s consumer spending report, GDPNow had been indicating growth of 2.3% for the quarter.”

Consumers are fearful. Oh, by the way, consumers are voters.

Ipsos polling since the election has shown something quite fascinating: Many of the fundamentals that got Trump elected in the first place have worsened for him, and Americans are blaming him and his policies for that.

In fact, Ipsos points out in a recent analysis that there are five critical takeaways to understand what is happening with Americans souring attitudes on the economy in the Trump era and I’m going to cover them here for you:

The honeymoon is over. The post-election boost in consumer confidence has evaporated. Across multiple metrics—including presidential job approval—Trump’s usual “honeymoon period” has disappeared. As I noted last week, his approval ratings have fallen back to their historical range. But here’s the critical difference: We’ve never seen Trump’s approval ratings decline alongside a crashing consumer confidence index. Yes, his numbers dipped during COVID, but that was largely seen as a crisis beyond his control. While hardcore MAGA supporters may continue to defend him, not all Republicans are MAGA—and independents certainly aren’t. Over the next few months, we’ll get a clearer picture of just how low Trump’s floor can go.

Job security has risen as a critical concern for American workers. During Biden’s presidency, the dominant economic anxieties were inflation, affordability, and the cost of living—not job security. Most Americans felt secure in their employment but struggled to afford their lifestyles. That has changed. Worries about job security have surged, and concerns about investment outlooks are growing. If, as many predict, the stock market experiences a 20% correction in the next 6–8 months, we could see a sharp decline in consumer confidence heading into the midterms—a troubling sign for Republicans.

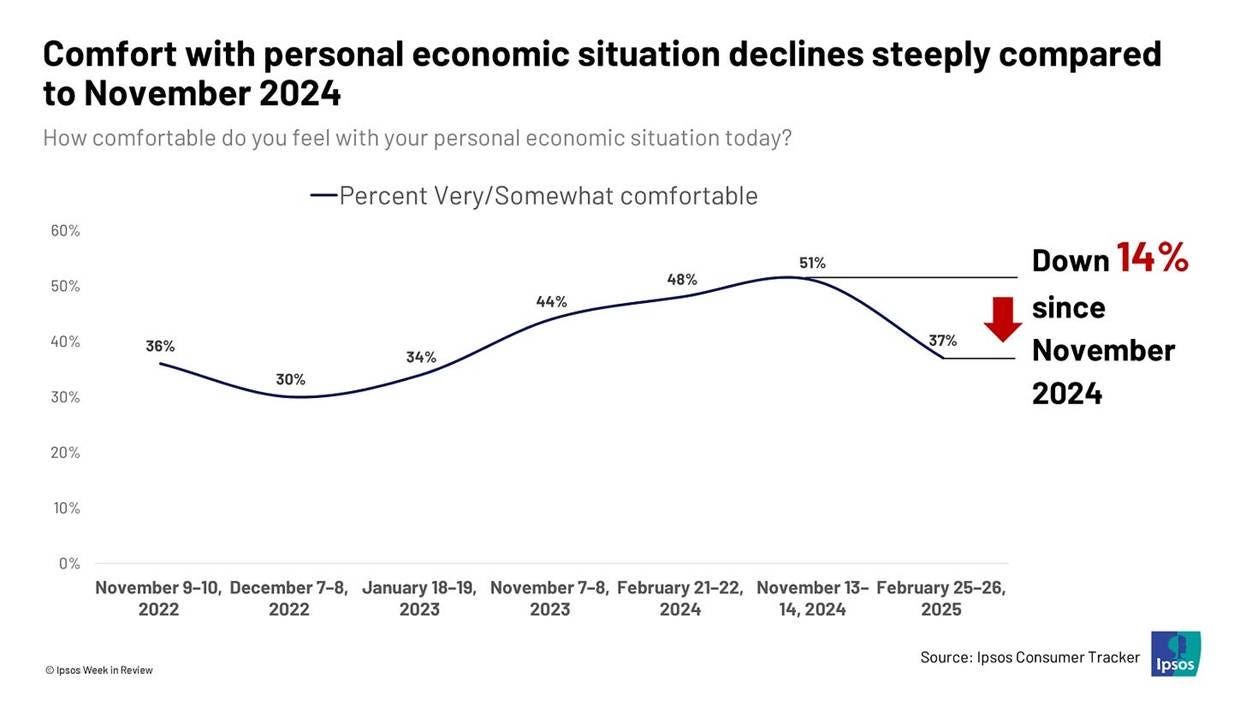

Americans’ personal financial situation has worsened. because the steep drop since the election is quite remarkable. Of all the economic data points I believe this metric may be the most important one to watch.

Polarized partisanship is driving Trump’s numbers lower. It’s no surprise that Republicans and Democrats view the economy through partisan lenses—Republicans tend to think the economy is terrible under Democratic presidents and vice versa. But polarization has intensified since the election. While this dynamic is nothing new, the speed and severity of the shift in economic sentiment among independents should worry the Trump administration.

Tariffs are taxes—so start calling them that.

If you criticize Democrats for poor messaging yet still use the term “tariff,” you’re part of the problem. These are taxes, and Americans react negatively to taxes. Roughly 40% of Americans say they’ve already seen prices rise due to Trump’s proposed tariffs—despite the fact that it’s too early for those policies to have had a direct effect. This signals that inflationary fears are now being tied directly to Trump.

There are countless political vulnerabilities to attack in Washington right now—too many to effectively focus on all at once. But one thing is clear: The economy was Biden’s Achilles’ heel, and Trump is making it worse in the eyes of American voters. His economic policies are proving to be more disruptive, unsettling, chaotic, and inflationary than stabilizing.

Trump is mishandling the economy. His opponents would be wise to flip the script and use the same economic attack lines that Trump wielded so effectively against Biden.

It's also important to note the stabilizing role that multiple federal entities play in the economy. Dismantling equals destabilization.

Let’s not lose sight of the fact that, as Mike and others have noted, Democrats’ numbers are in the toilet as well. Aspirational messaging about solutions to the affordability problem have to accompany the attacks on Republicans in charge.